estate income tax return due date 2021

Note that depending on the form filed an affirmative action to extend the original due date for filing the respective form may have been required. Imposition of tax on income of estates at rate of ten per cent of taxable income over twenty thousand dollars.

Federal Income Tax Deadline In 2022 Smartasset

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021.

. Calendar year estates and trusts must file Form 1041 by April 18 2022. November 2021 State holidays this month are Thursday November 11. Partnership and S-corporation returns IRS Form 1065 IRS and Form 1120-S respectively.

The law requires taxpayers to properly address mail and ensure the tax return is postmarked by the May 17 2021 date. Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that. Form 1040 for Individuals 18th April 2022.

Residents This is an extended due date. Additionally foreign trusts and estates with federal income tax filing or payment obligations who file Form 1040-NR now have until May 17 2021. Additionally foreign trusts and estates with federal income tax filing or payment obligations who file Form 1040-NR now have until May 17 2021.

Application for Extension for Filing Estate or Trust Tax Return. Fin CEN 114 FBAR. And Friday November 26.

Returns for partnerships and S-corporations are generally due March 15. Due Date For Filing. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020.

Adjusted corrected and amended returns. DOR 2021 paper returns are available DOR prior year returns are available. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia.

2021 AFSP deadline postponed to May 17. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041.

Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return. Beneficiarys Share of North Carolina Income Adjustments and Credits. Page 2 of 19 IT-205-I 2021 New York State resident and nonresident estate and trust and part-year resident trust defined For purposes of the New York State income tax an estate is either a a resident estate or b a nonresident estate.

See Special Notice 2003 200311 Legislation Affecting the Controlling Interest Transfer Tax. But for 2021-22 its 31st July. For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year.

Therefore the filing deadline for your 2021 personal tax returnForm 1040 or Form 1040-SRis Monday April 18 2022 April 19 if you live in Maine or Massachusetts. If not a private. Income distributions are reported to beneficiaries and the IRS on Schedules K-1 Form 1041.

Date entity created. ESTATE INCOME TAX Table of Contents. Date on which taxpayer of an estate must file return with full amount of tax due.

Owner or Beneficiarys Share of NC. Nonexempt charitable and split-interest trusts check applicable boxes. Form W-2 W3 1099 NEC and 1096 NEC.

13 rows Only about one in twelve estate income tax returns are due on April 15. Form 1065 for Partnerships 15th March 2022. NC K-1 Supplemental Schedule.

The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. If the due date falls on Saturday Sunday or legal holiday the return or voucher may be filed on the first business day after the due date. Individual Income Tax Return.

The due date of the estate tax return is nine months after the decedents date of death however the estates. Form 1120 for C-Corporations 18th April 2022. Extensions Personal income tax extensions must be filed on or before April 19 2022 and will not be accepted after midnight on that date.

Returns for partnerships and S-corporations are generally due March 15. C Employer identification number D. January 24 2022 is the first date that the IRS will accept 2021 federal income tax return filings.

Due date of return. Form 1040 US. Link is external 2021.

Due Date April 18 2022 The 2021 Connecticut income tax return for trusts and estates and payment will be considered. TAX DEADLINES ORGANIZED BY DATES FOR INDIVIDUALS APRIL 18 JUNE 15 OCTOBER 17 DECEMBER 15 US. So you must make sure that you file your returns on time or you would have to pay penalties and will miss out on certain benefits.

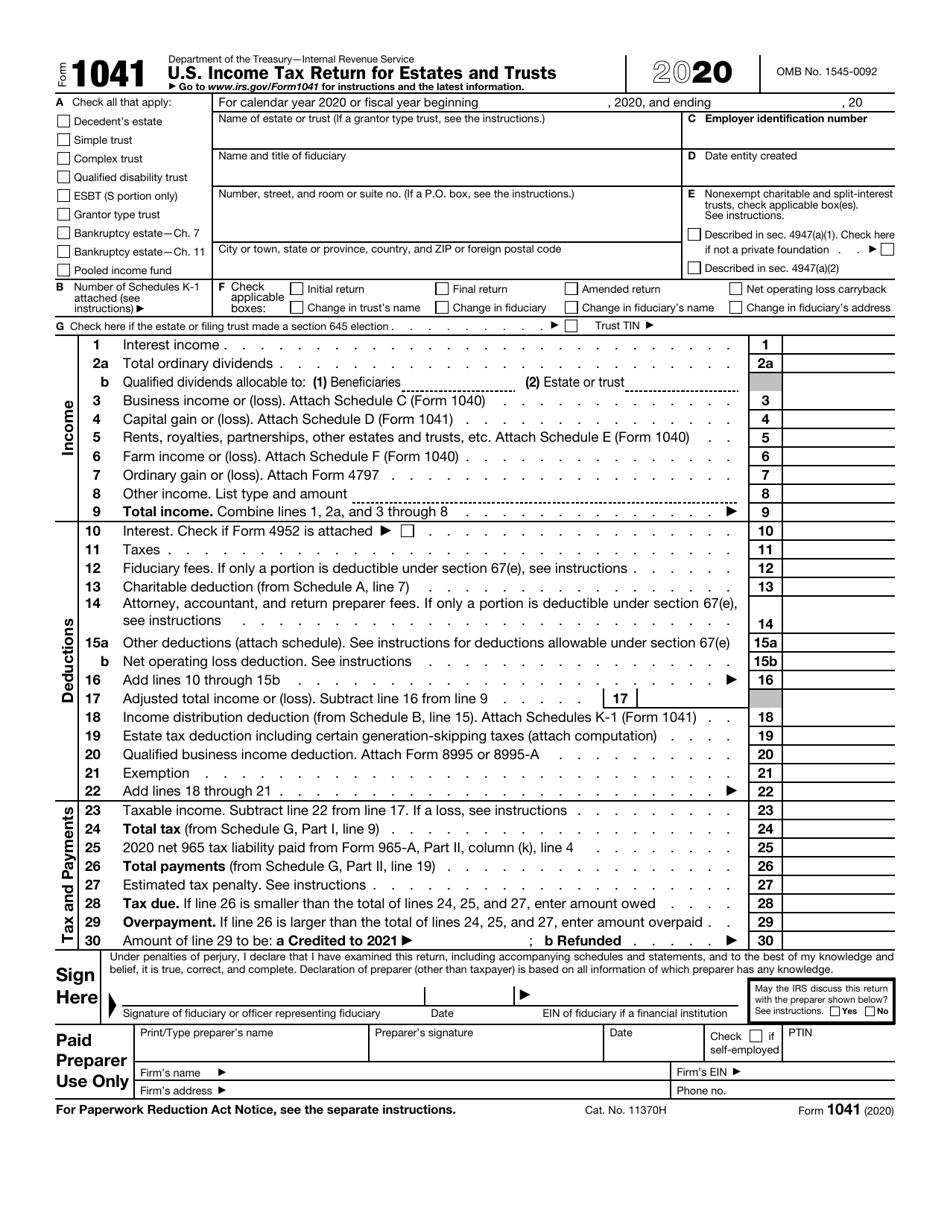

B Number of Schedules K-1 attached see instructions. The federal estate tax return has to be filed in the IRS Form 1041 the US. If the due date falls on a Saturday Sunday or legal holiday you can file on the next business day.

If the tax year for an estate ends on June 30 2020you must file by October 15 2020. Fiduciary extensions still must be filed on or before April 19 2022 and will not be accepted after midnight on that date. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely.

However for FY 2020-21 the income tax return due date was 31st December. If you live in Maine or Massachusetts you have until April 19 2022. Income Tax Return for Estates and Trusts.

Form 1041 for Trusts and Estates 18th April 2022. Penalty for Late Filing of ITR. Form 1120S for S-corporations 15th March 2022.

Income Tax Refund Not Received L Last Date Of Filing Itr L Itr Refund

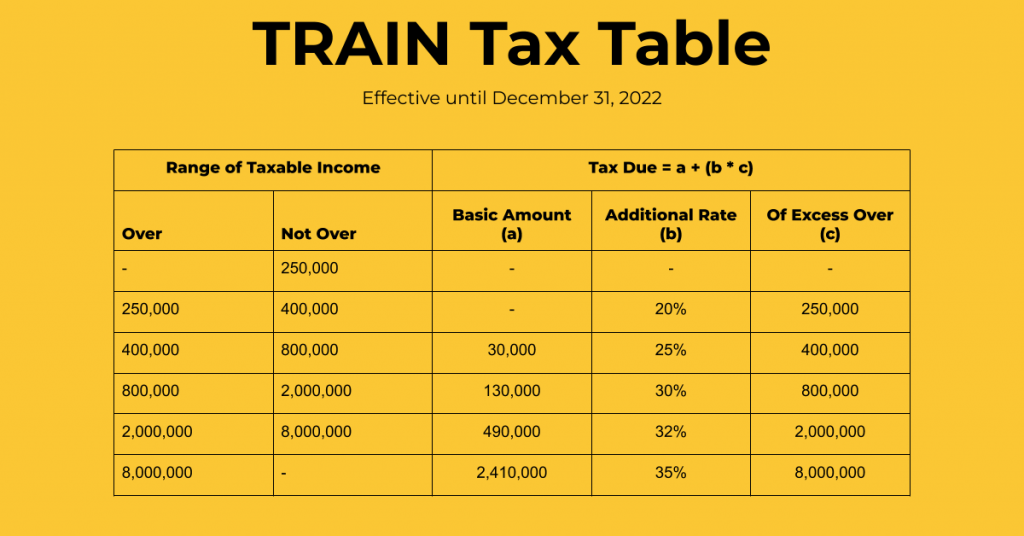

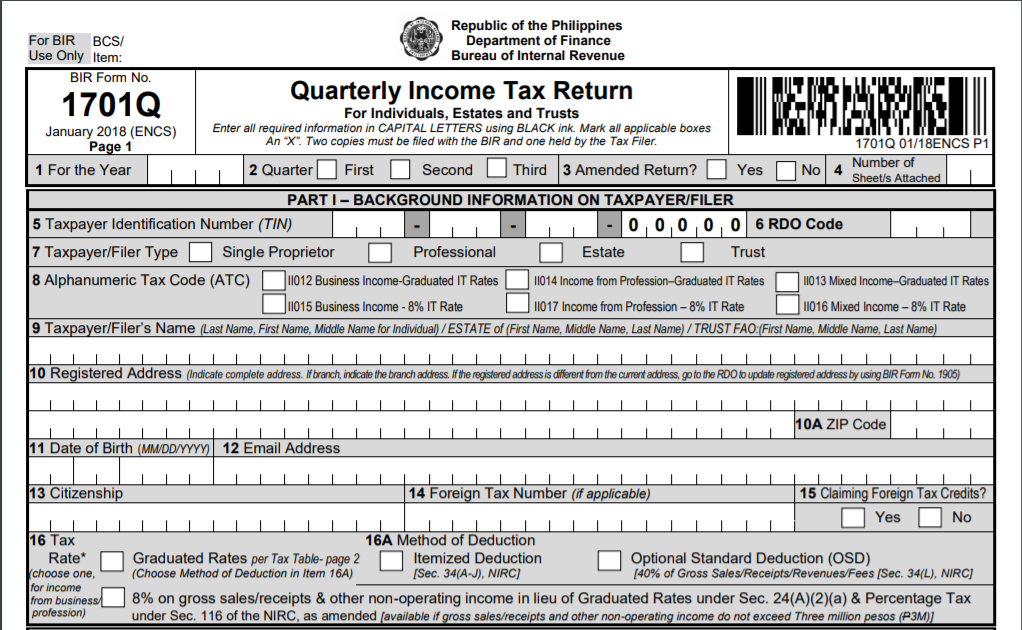

How To File Bir Form 1701q A Complete Guide For 2021

Important Changes For Filing Itr For Ay 2021 22

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Last Date To File Itr Due Date For Filing Itr For Fy 2020 21 Ay 2021 22 New Itr Filing Deadlines Tax2win

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Estate Tax

How To File Bir Form 1701q A Complete Guide For 2021

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax Year 2021 Irs Forms Schedules You Can Efile In 2022

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Irs Form 1041 Download Fillable Pdf Or Fill Online U S Income Tax Return For Estates And Trusts 2020 Templateroller

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service